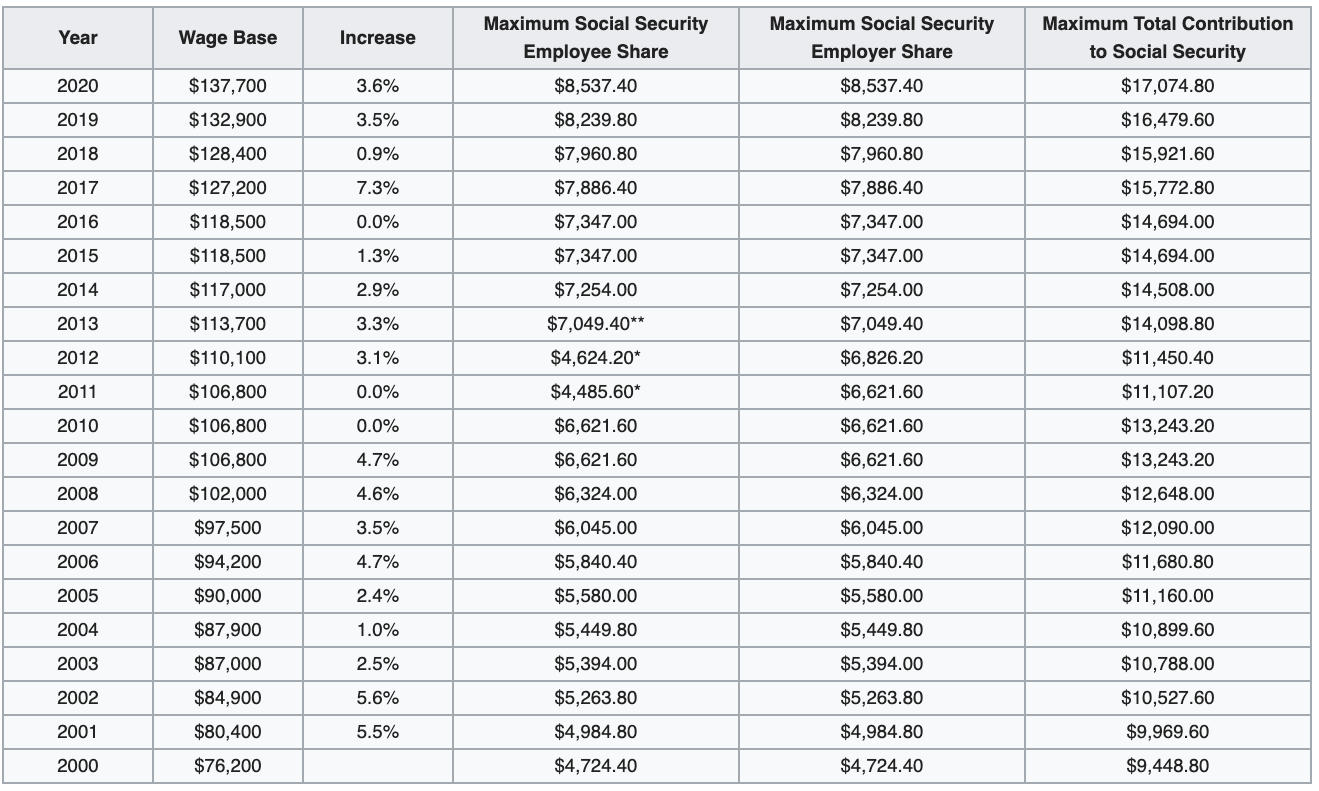

Social Security Max 2025 Tax Withholding. For 2025, an employee will pay: The social security wage base for 2025 is $160,200, and $168,600 in 2025.

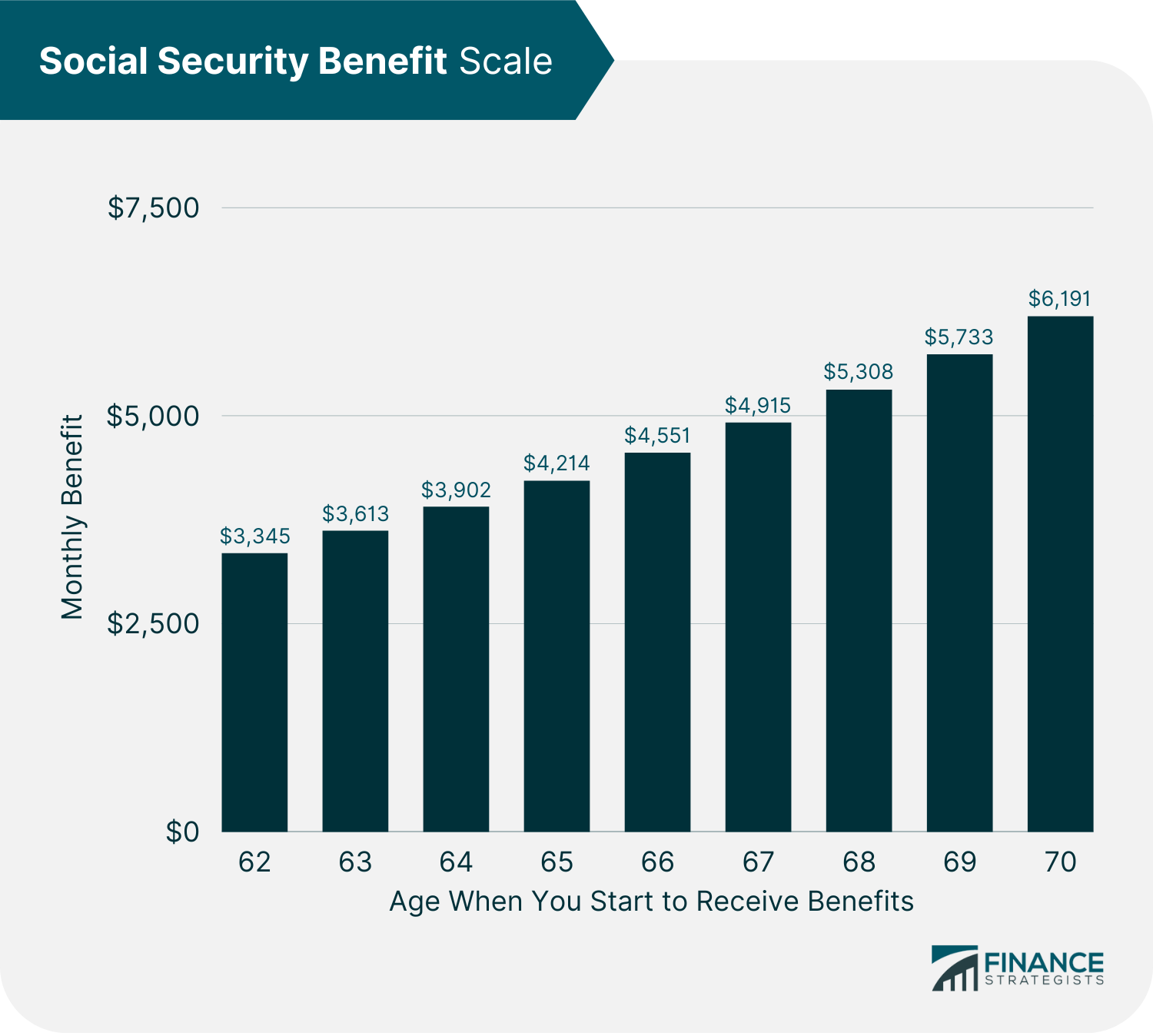

11 rows if you are working, there is a limit on the amount of your earnings that is taxable by. Social security recipients received a 3.2% increase in their benefits in 2025, and some retirees are concerned that this year’s increase is not big enough to meet their needs.

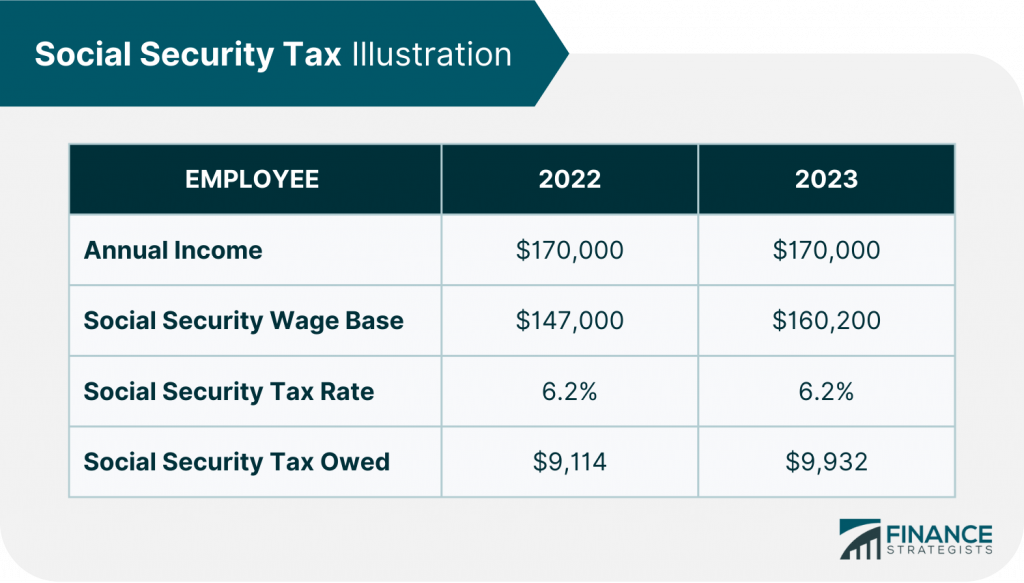

What Is Max Social Security Withholding 2025 Emyle Francene, In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600.

2025 Max Social Security Tax Withholding Ilyse Leeanne, We call this annual limit the contribution and benefit base.

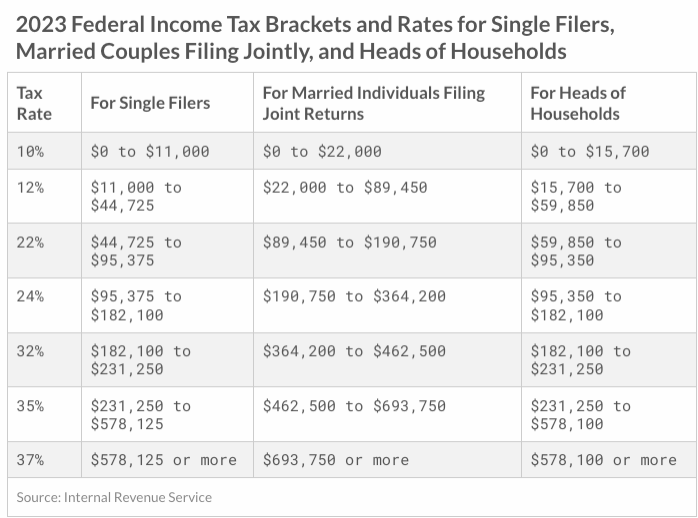

2025 Max Social Security Tax Withholding Ilyse Leeanne, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each.

Social Security Tax Limit 2025 Withholding Chart Debbi Ethelda, The social security administration recently announced that the wage base for computing social security tax will increase to $168,600 for 2025 (up from $160,200 for 2025).

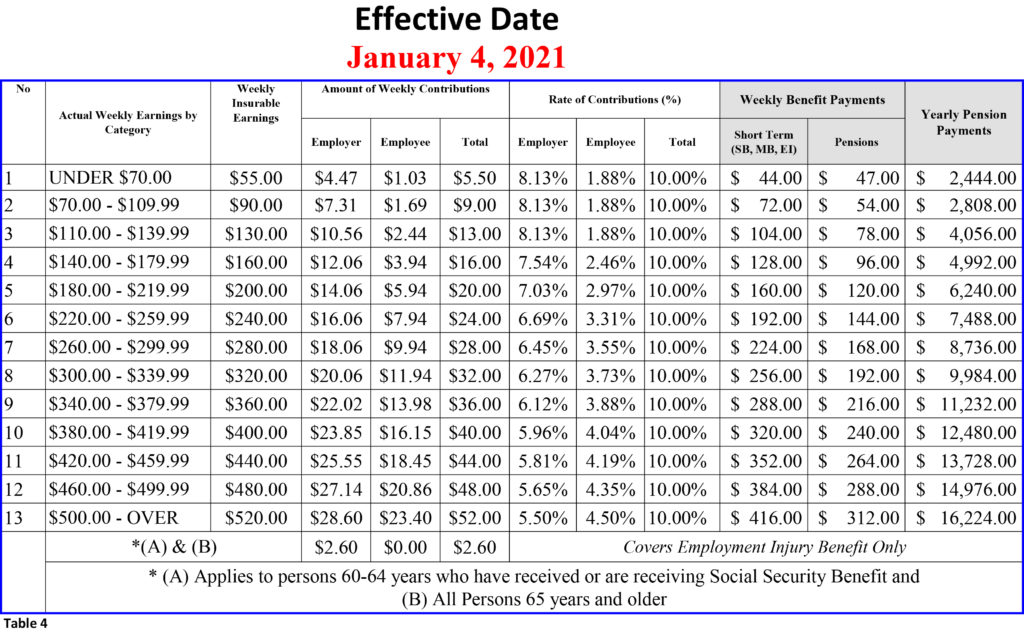

Social Security Tax Limit 2025 Withholding Chart Mavra Sibella, For 2025, the fica tax rate for employers will be 7.65% — 6.2% for social security and 1.45% for medicare (the same as in 2025).

Social Security Max Withholding 2025 Tessa Gerianna, Salaries earned above that amount are no longer subject to additional social security taxes for the calendar year.

2025 Maximum Social Security Tax Kate Sarine, One of the most anticipated announcements is the 2025 cola, which was just officially revealed on october 10, 2025.

Maximum Social Security Tax Withholding 2025 Olympics Hatti Koralle, You can ask us to withhold federal taxes from your social security benefit payment when you first apply.

Maximum Social Security Tax 2025 Withholding Melly Sonnnie, So, if you earned more than $160,200 this last year, you didn't have to pay the social security.

Max Social Security Tax 2025 Withholding Table Reyna Clemmie, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400).

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)