401k Deferral 2025. More than this year, if one firm’s forecast is any. There are limits to how much employers and employees can contribute to a plan (or ira) each year.

In 2025, the most you can contribute to a roth 401. For 2025, the elective deferral limit is estimated to be $24,000.

The amount of salary deferrals you can contribute to retirement plans is your individual limit each calendar year no matter how many plans you’re in.

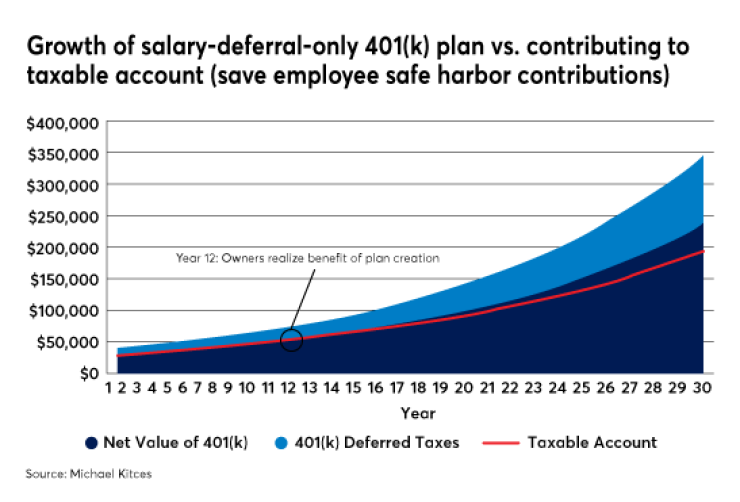

Taxdeferralsavingssmallbusiness401(k) Michael Kitces Financial, Defined contribution retirement plans will be able to add. Savers who want to convert solo 401 (k) funds to roth funds.

401(k)ology The Missed Deferral Opportunity, More than this year, if one firm’s forecast is any. The new provision will begin on jan.

What’s the Maximum 401k Contribution Limit in 2025? (2025), Those who are age 60, 61, 62, or 63 will soon be able to set aside. The amount of salary deferrals you can contribute to retirement plans is your individual limit each calendar year no matter how many plans you're in.

401(k)s and Other Salary Deferral Plans American Funds, Every year, the irs sets the maximum 401 (k) contribution limits based on inflation (measured by cpi). 29, 2025, to automatically enroll participants in the plan at an initial deferral rate of between 3% and 10% of compensation once.

401(k) Deferrals How Much Is Enough?, 401k 2025 employer contribution limit irs. Employees will become eligible to make deferrals after.

401(k) Plans Robert F. Murray Financial Solutions, LLC, How much will the maximum 401(k), 403(b), and 457 deferrals for defined contribution plans rise in 2025? There are actually multiple limits, including an individual.

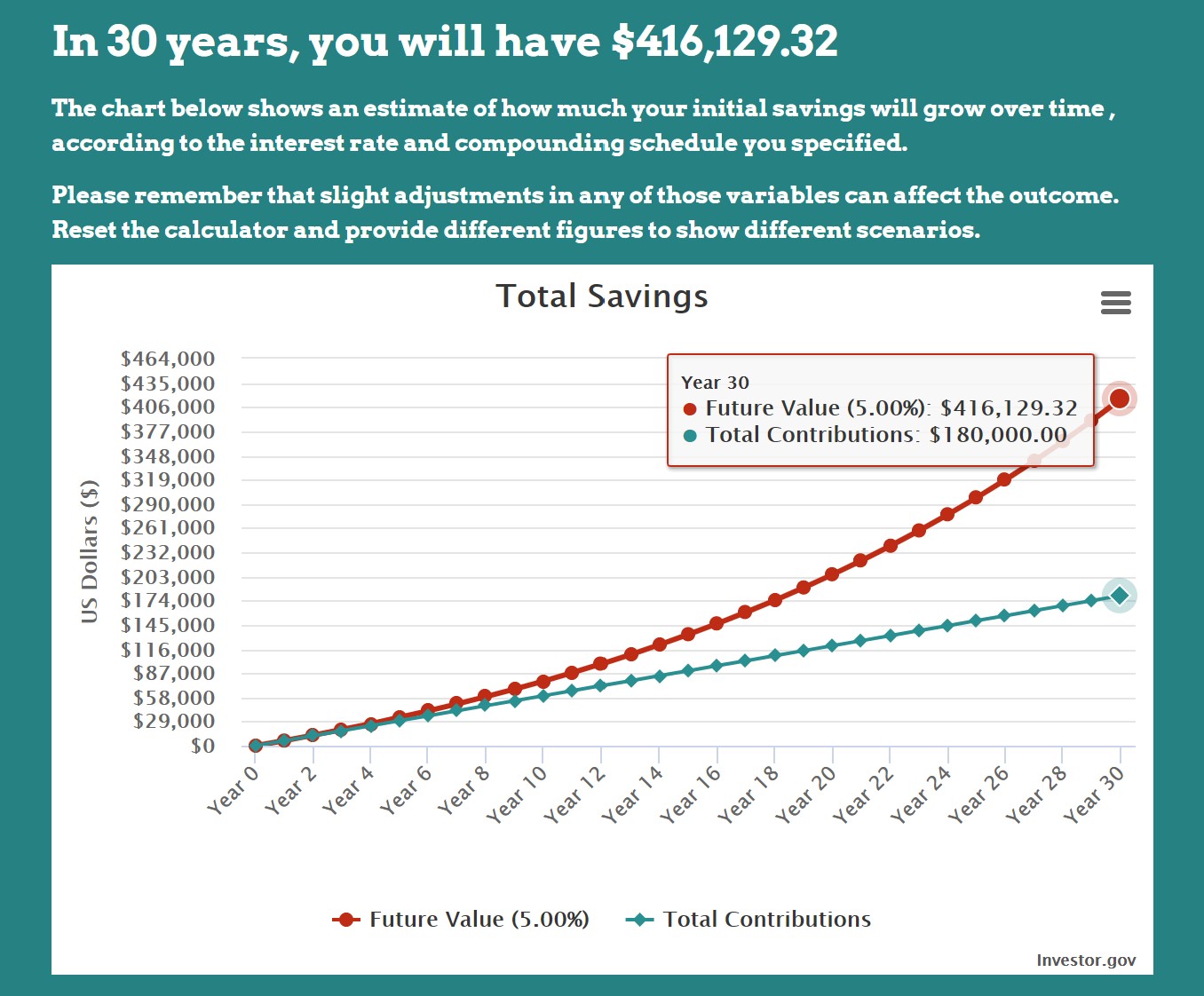

Why plan sponsors should boost 401(k) default deferral rates Employee, Every year, the irs sets the maximum 401 (k) contribution limits based on inflation (measured by cpi). Actuarial consultant milliman predicts a $1,000 increase in the 401 (k) elective deferral limit for 2025, raising it to $24,000, and a $2,000 rise in.

401k Plan, Elective Deferrals, Improperly Excluding an Employee, Until 2025, when the secure 2.0 rules apply (two years of service at. Beginning in 2025, employers with new 401(k) and 403(b) plans must automatically enroll employees when they become eligible.

What Is A 401(k) Match? — OnPlane Financial Advisors, Secure 2.0 requires new 401(k) plans adopted on or after the date of enactment, dec. Savers who want to convert solo 401 (k) funds to roth funds.

Different Types of 401(k) Plans Advantages Finance Strategists, For 2025, the irs limits the amount of compensation eligible for 401 (k) contributions to $345,000. The new provision will begin on jan.

Top Ten Christian Songs 2025. Popular christian music and new christian music featuring lauren daigle, […]